Building Credit

Matt Seinberg

I started to build my credit when I was 18-years-old; at the time, it was easy to get many credit cards. The first card I had was from Sears. Do you remember them? I applied at the Roosevelt Raceway Flea Market and got the card in the mail shortly thereafter.

I built up a stock of credit cards.

With that in hand, I used it to get gas station cards, such as Mobil, Exxon and Gulf. There was a hot promotion at the time; bring us theirs and we will give you ours. I did.

For some reason I couldn't get a Visa or MasterCard, but I did get a green American Express (Amex) card with some creative thinking. Those were the days where you could actually call somebody up and talk to that person as needed. I needed my employer to state I was making a certain amount of money to qualify for the Amex card, so I had a letter written, which I faxed to my account representative. Lo and behold, approval for the card came through.

For many years I used the Amex car, until the annual fee because too much to bear. I did use their sign and travel feature, which allowed paying vacation charges over time, instead of at the end of every statement period.

Eventually, I dropped the Amex after I got my first MasterCard. I also dropped most of the gas and department store cards as well. There wasn't a need for them at that point.

Back in the 1980s, it was easy to build your credit because the internet didn't exist. You talked to people who would actually help get what you needed. It's amazing what a little friendly talking will do and still does, if you can get a person on the phone.

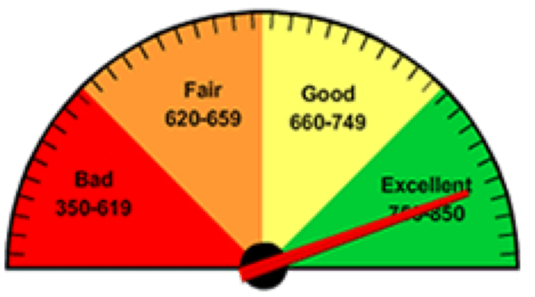

I checked my credit score the other day and it was a perfect 850. You cannot get any higher than that, so it's a reason to be proud. Did you know that every time anyone checks your credit, for any reason, it's a minimum 3-point reduction? The last time it happened was when I leased my car in 2018.

Young people today do have many options to get credit. My older daughter Michelle applied for an Amazon Visa, but didn’t get one. She then applied for a Discover card, and approved, instantly, for a student card. Since she is now out of school, she can try for a regular card.

Melissa is credit wise.

My younger daughter Melissa had a TD debit card, but it was too restrictive. She had to go to Chase, with my father, for some reason, and opened a new checking account there; she also got a student Visa. She knows how to use it and when to use it, so I'm not worried about her going on a huge shopping spree.

Many people don't start building their credit early enough. When they hit adulthood, they encounter a rash of problems. Did you know that without a good credit score, you are not able to rent an apartment or even a car? If you want to buy a car, best have cash or a co-signer with good credit.

There are plenty of ways to build credit or repair bad credit. If you want to furnish your new apartment, there are three companies to help you. They are Rent-A-Center, Cort and Aarons. All are lease-to-own companies that get you everything from a bed to a television.

The catch is high interest rates and fees. The upside is they report on time monthly payments to all three credit-reporting agencies. Pay on time and pay it off, your credit score will most likely go up a minimum of fifty points. Stop paying and you're a skip; say good-bye to credit buying. Good luck in getting any credit after that, since they report that as well.

I have customers, at the store where I work, that swear up and down their credit is fine. Then we run it and they are turned down so fast their heads spun. They knew it and wanted to try it anyway. Some people go from store to store looking for credit, not realizing how many points are lost off their credit score, just for applying.

I had one young woman, many years ago, come in to buy furnishing; she picked it all out and applied for credit. I knew there was no way she get it. She didn't want to wait, so I called her an hour later and told her. She said thank you and hung up. She didn't care and was trying to see who would approve her, if any. I doubt she got credit that day or the next.

Start early and pay on time.

My advice is to start at age 18 with a debit card and then get a credit card from that same bank. They love to please their customers. They will figure out a way to get you started. Always pay on time, don't miss payments and pay in full if you can. If you don't, the interest charges can start to build up.

Matt Seinberg lives on Long Island, a few minutes east of New York City. He looks at everything around him and notices much. Somewhat less cynical than dyed in the wool New Yorkers, Seinberg believes those who don't see what he does like reading about what he sees and what it means to him. Seinberg columns revel in the silly little things of life and laughter as well as much well-directed anger at inept, foolish public officials. Mostly, Seinberg writes for those who laugh easily at their own foibles as well as those of others.

- Hurricane Sandy 1

- Kids and Music

- Channel Changes

- Obsessive Cat Disorder

- Uneasy Politics

- Dogs or Cats

- No Clue

Click above to tell a friend about this article.

Recommended

- David Simmonds

- The County Helps Paris

- Covid-19 and Basketball

- Progress

- Sjef Frenken

- A Fine How-dy Do

- Social Intercourse

- La Vie en Rose

- Jennifer Flaten

- Mustaine: a review

- New Match

- Moving Up

- M Alan Roberts

- Truth Unbound

- Checkmate

- Chicken Truck

Recommended

- Matt Seinberg

- Missing Socks

- Foggy Radio

- Graduation and Prom

- Bob Stark

- Crossing the Line

- Time Lock Wedge

- Paranoid Society

- Streeter Click

- Stand-up Comic

- Dick Summer Top 40

- Courtney Love Writes

Recommended

- AJ Robinson

- Walking

- Finding Your Niche

- The Calendar

- M Adam Roberts

- Working for the Man

- Take Your Shot

- Thanks a Million

- Ricardo Teixeira

- The Future

- There is a Light

- The Unicorn